India continues to face a growing challenge with rising poverty rates. A trust is a non-governmental organization established to promote social welfare and address societal issues. Its objectives include advancing education, eradicating poverty, creating employment opportunities, and improving the literacy rate in the country. Trusts are categorized into two types: public and private. Public trusts enjoy greater privileges and exemptions compared to private trusts.

A registered trust gains official recognition, allowing it to operate as a legitimate entity under the law.

Public trusts are eligible for various tax benefits and exemptions under the Income Tax Act, encouraging philanthropic activities.

Registration increases trustworthiness and transparency, attracting donors and stakeholders to support its initiatives.

Registered trusts can benefit from government grants, subsidies, and programs aimed at social welfare.

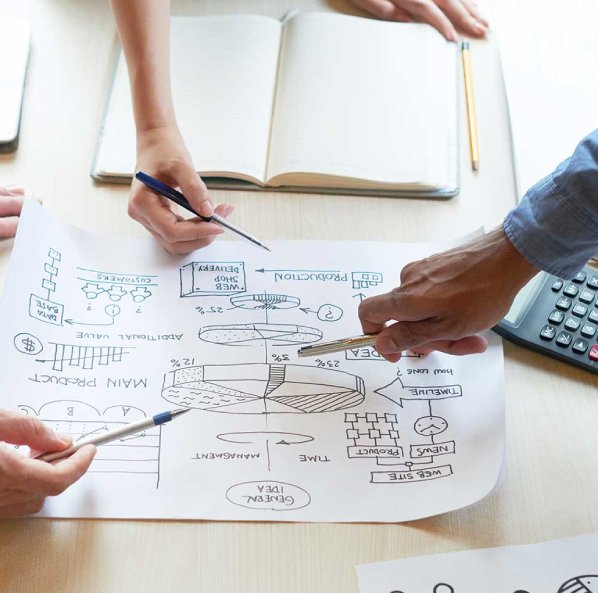

Aadhar / Voter ID / Driving licence / PAN of the trustor and trustees.

The Address proof of all the members, Proof of the registered place of business (Ownership documents/ rent or lease agreement), any bill in relation to electricity /landlord bill / bank statement and Document in relation to proof of address.

The photos of the applicant should be submitted for the clarification and proof of the concerned members.

A trust deed on stamp paper based on the value of the property and belongings must be mentioned in the deed.

No objection certificate from the landlord must be enclosed in case of rental agreement.

Our esteemed professional team would guide you with other requirements based on the nature of trust (public or private).

PAN card, book- keeping, Accounts, Annual IT filing, Shops and Establishment License in case of employment and professional tax in applicable.

Minimum of 2 people and maximum no limit.

Yes, trust deed is mandatory to register the trust. It must compile all the information and details regarding the members and its regulations.

Yes, 2 witnesses are required for the registration of trust.

If you have any further queries, get our experts’ opinion. For free consultation Contact our Taxteam to resolve all your queries.